Fragmentation Wars: Derivatives Edition

The largest issue with the brightest minds solving it

A tale as old as crypto itself.

Liquidity fragmentation is one of the largest issues in our space and sees some of the brightest minds working toward its resolution. I find this topic particularly interesting because the team at Entangle is working directly on solving this exact issue for spot assets. Watching the space evolve and gradually break down the barriers to reach mass adoption is truly exciting for myself.

We'll take a bird's-eye view of:

Tradfi

Liquidity

Infrastructure

And most importantly, the two protocols leading the charge

If you've noticed, the title says "derivative edition". I plan to create a part two where we delve deeper into liquidity fragmentation across spot assets and discuss who's tackling the major challenges. The reason I find derivatives going cross-chain so captivating is that it's like supercharging the current infrastructure. Derivatives are a game of latency, as you'll see described in the section below. Due to block lag times and different consensus mechanisms, it creates an immensely challenging puzzle to solve.

But I'm sure you've heard the saying: hard problems create strong men, strong men pump my bags, and weak men get rug-pulled.

Centralized vs Decentralized

Tradfi

In tradfi, especially within the stock and derivatives markets, High-Frequency Trading (HFT) accounts for a significant volume. The essence of HFT is its speed, with traders competing for advantages on scales measured in milliseconds and even microseconds. To achieve such speeds, financial institutions and trading firms have invested heavily in infrastructure development.

A vital component of this infrastructure is fiber-optic cables, which transmit data at the speed of light. These cables crisscross continents and even run along ocean floors, all in a quest to reduce latency. A standout example is the fiber-optic cable from Spread Networks that runs between Chicago and New York. It's specifically optimized for the derivatives trading community, underscoring the central roles both cities hold in the futures and equities arenas.

Furthermore, to reduce latency even more, many financial exchanges offer co-location services. This allows trading firms to place their servers in close physical proximity to the exchange's systems. However, it's worth mentioning that, despite these lightning-fast execution speeds, settlement times in traditional derivatives markets might not always be as prompt. A trade, although executed almost instantaneously, could have a settlement time of T+1 or even T+2 days, depending on the specific market.

Crypto

Shifting our gaze to crypto derivatives, the speed at which they operate is intrinsically tied to their underlying blockchain. For instance, a transaction on Bitcoin's blockchain might take approximately 10 minutes to confirm. In contrast, Ethereum's block time averages around 13 seconds. The fastest of them all is Solana, clocking in at 400ms. Just imagine telling that to tradfi HFTs!

A significant number of crypto exchanges opt for off-chain trading, where trades are first recorded in centralized databases. It's only when users initiate withdrawals that the transaction is broadcast to the blockchain. This approach guarantees trade execution that rivals the immediacy found in traditional platforms.

Then there are Decentralized Exchanges (DEXs), which are non-custodial in nature and execute trades directly on the blockchain. Consequently, the speed of a DEX is dependent on its parent blockchain. This leads to scenarios where a trader on an Ethereum-based DEX might have to wait for multiple block confirmations. Addressing the broader concerns of speed and scalability in the crypto domain, many are now focusing on Layer-2 solutions or even building their own infrastructure. These innovative platforms, built atop foundational blockchains, promise faster transaction processing. When applied to derivatives trading, they often surpass the speeds achievable on primary blockchains.

Derivatives Liquidity

It's insightful to take a moment and consider the disparities in liquidity and systems when designing derivatives. In Tradfi, HFT accounts for a significant portion of trading, especially in equities. However, this metric isn't always straightforward to gauge, as not all platforms offer transparent volume statistics.

Historical data sheds some light: In the early 2010s, HFT was responsible for an estimated 60-70% of U.S. equities trading volume. In futures, especially with contracts like the E-mini S&P 500, HFT was thought to account for half, if not more, of the trading volume by the mid-2010s. While HFT does play a role in the options market, its influence is not as pronounced as in equities or futures. Geographically, the impact of HFT varies—it's more predominant in U.S. and European markets than in certain Asian regions.

HFT's role has evolved over time. Although it surged in prominence from the late 2000s to the early 2010s, factors such as regulatory changes and market saturation have since tempered its overwhelming presence.

Acknowledging HFT is crucial since revenue from crypto derivatives is directly linked to volume. If the aim of crypto is to emulate what Tradfi offers but in a decentralized manner, then the infrastructure must be tailored accordingly. Pitching a new ultra-fast perpetual platform to an HFT firm, given the current state of technology, would likely be met with a laugh directly to your face.

As markets mature, so does trading sophistication. If Wall Street is any indicator, then our quantitative allies, like Jim Simmons and co, stand out as leading contenders. Their noticeable absence can be attributed to inadequate liquidity and infrastructure for their trading needs - they are simply big fish in a small pond. That is, unless Larry Fink decides to intervene...

Build own infra vs using 3rd party

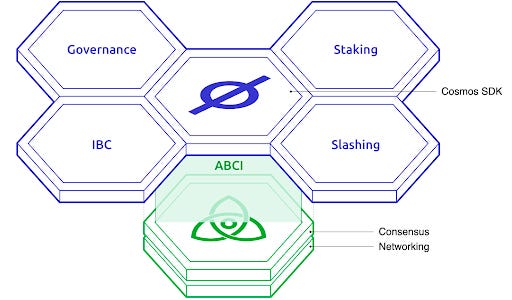

I won’t dwell on this for long, as most of us will fall asleep reading infrastructure articles. There are numerous benefits to either building your own infrastructure (like Cosmos) or integrating with existing solutions such as Optimism. The Cosmos stack is unique in being the first where Optimism plugs into existing parts of the full stack.

Cosmos offers a consensus and networking engine, but you don't inherit any inherent security. Its value is only as strong as the validator set you can recruit and the value of your token. Cosmos provides the SDK, which comprises various application modules. Not mentioned here is CosmWasm, a virtual machine akin to the EVM.

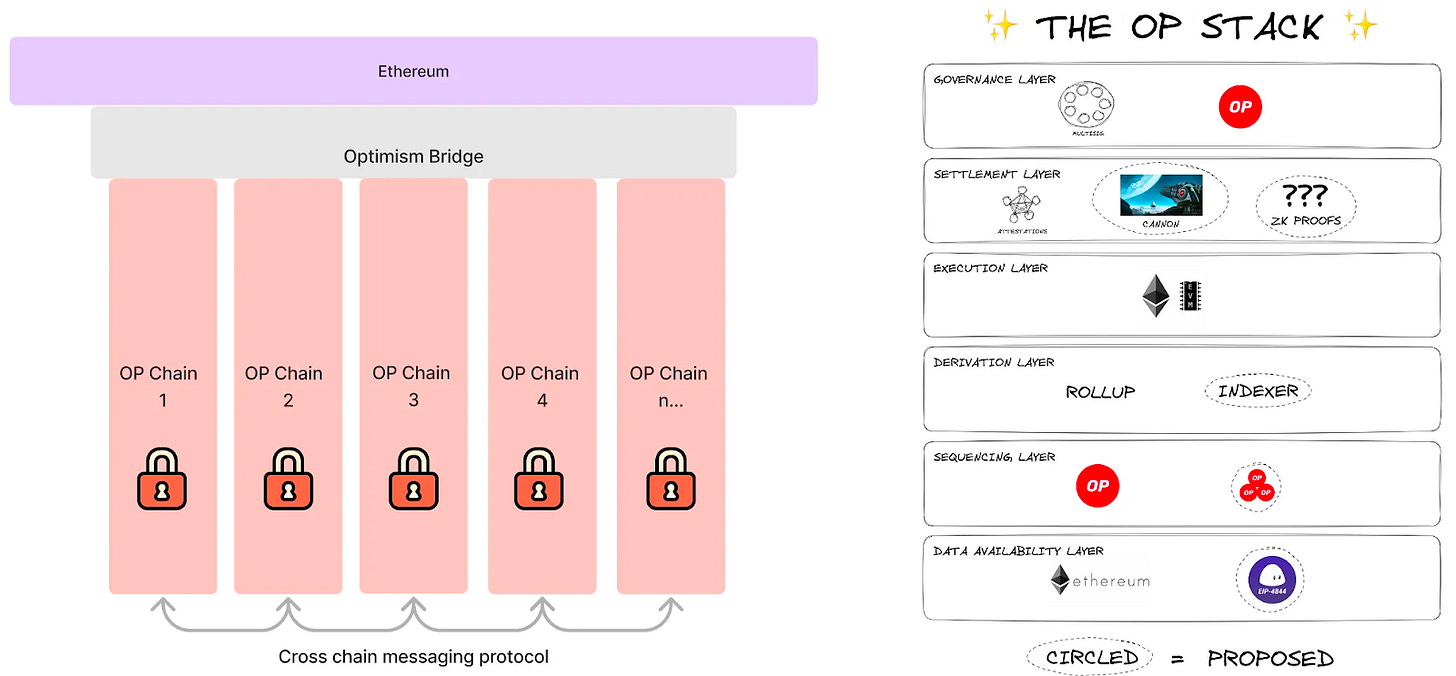

On the other hand, the Optimism stack leverages tools and benefits from the network effects of the EVM. It doesn't aim to construct a new VM; instead, it integrates what most apps are currently utilizing. What's being introduced here is the sequencing layer, offering a toolkit to provide various options for how you'd like your rollup or chain to manage sequencing. The ultimate goal is to simplify the process, making it as straightforward as possible to progress from zero to one.

Benefits & Trade offs

This is where things get intriguing. Imagine you're a startup that has recently secured $5 million in seed funding. This gives you roughly a two-year runway to amass enough users and revenue to either pursue a Series A round or become self-sustaining.

Now, picture the necessity of constructing your own infrastructure on top of your applications and ensuring they operate flawlessly, significantly outdoing other alternatives. This is the challenge Cosmos faces, explaining the limited adoption of their SDK. The high stakes and minimal ecosystem funding plus awareness mean that only the most established players, with extensive runways, can afford to gamble on this approach.

Enter platforms like dYdX, which validate this thesis, especially if users are prepared to migrate for an enhanced trading experience. To genuinely craft a dominant Perps dApp that can rival CEXs in execution, I'm skeptical that the Optimism stack can deliver the requisite capabilities.

However, for startups or those seeking rapid growth due to a constrained runway, bypassing solutions like Optimism or similar ecosystems seems nearly implausible. Given the structure of crypto, these blockchains function as lifelines for protocols, thanks to the brand recognition and ecosystem grants they offer. For instance, if a blockchain's price and TVL surge, it's highly likely that your protocol, especially if you're the "native" dApp, will experience a similar boost, possibly achieving a breakout because all eyes are on you.

This poses a dilemma, as dApps may be incentivized for less-than-ideal reasons. Ideally, builders should prioritize superior technology and product quality. Yet, given the optics of crypto, they must play by certain rules to stand a chance at success. This is the niche that I believe Synthetix and Infinex are trying to fill. They recognize the leverage wielded by major chains and are exploring a counter strategy: creating "one giant liquidity pool" that spans multiple chains. Users won't even discern which chain they're transacting on, ensuring a streamlined front-end experience on par with CEXs.

Dydx vs Synthetix & Infinex

Synthetix & Infinex

Synthetix aims to develop a system where their liquidity can flow seamlessly across multiple blockchains for Perpetual platforms. The analogy would be using a single debit card across various banks without concern about its original issuing bank.

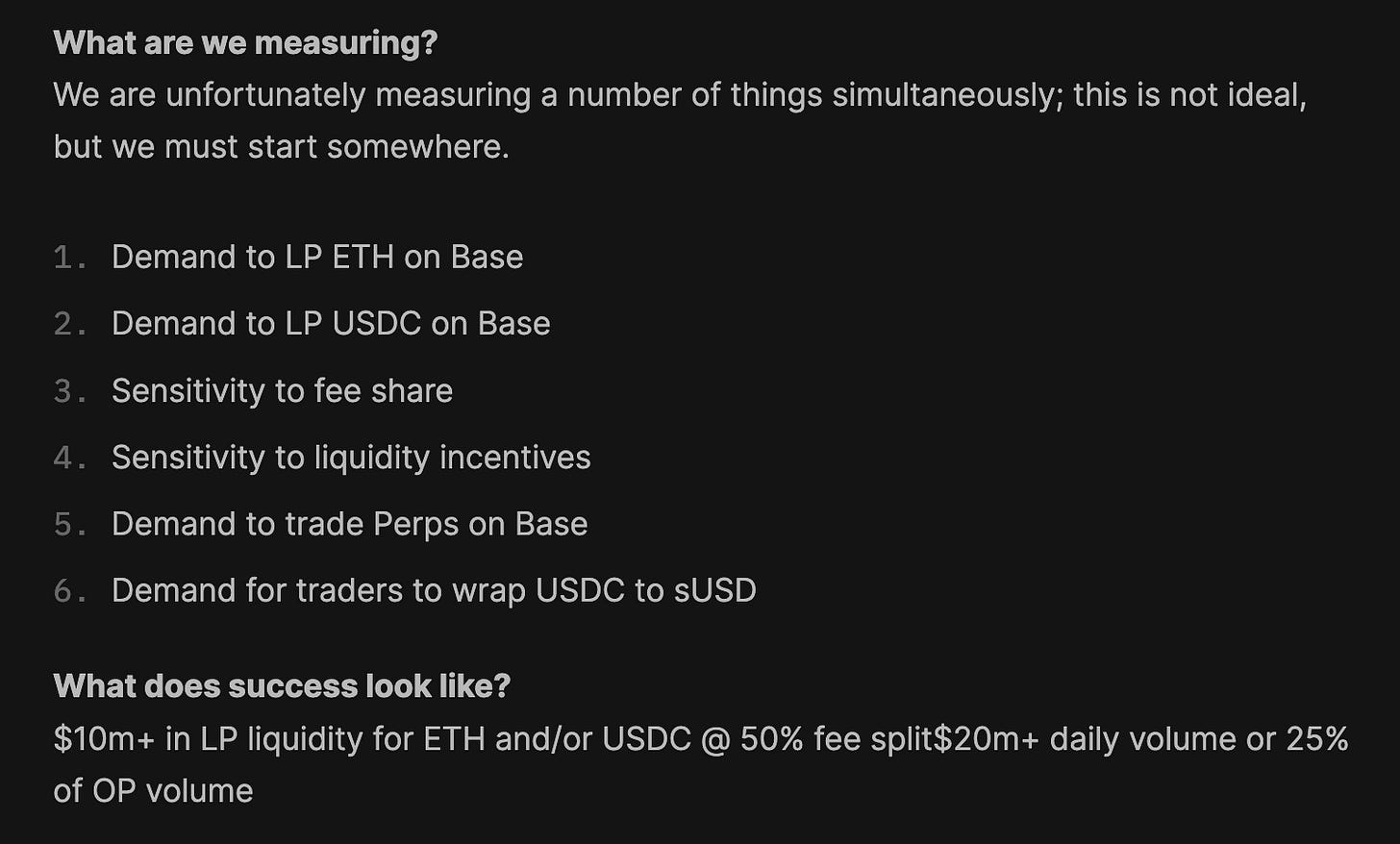

The objective appears to be the creation of "one giant liquidity pool" that can effortlessly interact cross-chain, equipped with the essential features for cross-chain liquidity in Perpetuals. Given that they employ the SNX token as the primary liquidity provider, there's an ongoing debate about whether to transition the LPing to ETH or underlying ETH LSDs to attract more users across "ghost" chains. However, the dilemma arises as to whether it's worth forgoing fee capture to potentially gain more users.

The proposed fee structure presents a captivating experiment. The plan is to distribute fees in a 20/40/40 split among integrations (dApps utilizing SNX liquidity), SNX holders, and liquidity providers. Kain, the founder, has suggested possibly eliminating the 20% revenue designated for integrations since he's developing his own front-end Perpetual protocol named Infinex. If I’m one of these integrated protocols I’d be shitting my pants as if I’m in Kains shoes, I’m pulling the plug on the integrated protocols and channeling all liquidity to strengthen Infinex.

Infinex aspires to be the premier cross-chain Perpetual protocol, connecting users across dominant chains and competing with dYdX in terms of speed. While it may sound like magic, if successful, it truly is. Kain's ambitious plans with Synthetix V3 involve transforming it into a dynamic liquidity hub, pushing the boundaries of cross-chain communication. The challenge lies in block lag times and consensus mechanisms, making this a massive experiment I'm eager to watch.

I'm particularly invested in this topic because of our endeavors at Entangle. We aim to forge a comparable system for LP assets, providing them with more utility beyond merely residing in a DEX. Our intricate cross-chain LSD applications rely heavily on our specialized Oracle solution. While Kain is currently leaning towards Chainlink's CCIP, the cross-chain capabilities of Entangle’s Oracle might be the key to actualizing this liquidity vision. Unfortunately I’m a small brain marketer and haven’t delved into the technical nuances yet, but it would be thrilling to see how we could contribute to this innovative venture since our mission aligns with optimizing liquidity.

By enabling this dynamic liquidity mechanism, Infinex could emerge as the primary ecosystem Perpetual platform, facilitating a user interface that can rival leading CEXs. What intrigues me most is that through account abstraction, there's potential to create a user experience that bypasses the typical crypto jargon. They might even design a wallet interface not bound by the often inconvenient 12-word phrases that few enjoy or remember. The times are evolving, and simplicity reigns supreme. The dApps that rise to the top in this bull run will undoubtedly be those offering the most intuitive user experience.

DYDX

The golden child of Perpetual DEX’s.

There's no doubt that dYdX has achieved something monumental, a feat I covered in great detail in one of my previous articles. With the upcoming migration to V4 and the integration of the Cosmos SDK, it stands out as the most exciting event in Cosmos, especially with its $400 million+ in accumulated revenue. If successful, this will greenlight their madness of building their own infrastructure to create a dApp that genuinely competes with centralized counterparts – an accomplishment previously never done before.

The fundamental problem with every L1 or L2 DYDX could develop on is that none can handle even close to the throughput needed to run a first class orderbook and matching engine. For reference, the existing dYdX product processes about 10 trades per second and 1,000 order places/cancellations per second, with the goal to scale up orders of magnitude higher.

They considered pivoting to developing another trading model, such as an AMM or RFQ system, but ultimately decided that an orderbook based protocol was critical to the trading experience pro traders and institutions demand. They also were not satisfied with existing off-chain orderbook systems that either did not include matching (huge problems with frontrunning and trade collisions) or were based on centralized matching (there can be no central systems in dYdX V4). This left them with the realization that we needed to build a decentralized off-chain network to run the orderbook.

This is where Cosmos comes in. A massive benefit of developing a blockchain dedicated to dYdX V4 is that it offers full customizability over how the blockchain itself works, as well as the jobs that validators perform.

In dYdX V4, each validator will run an in-memory orderbook that is never committed to consensus (i.e., off-chain). Orders placed and cancellations will be propagated through the network similar to normal blockchain transactions, ensuring that orders placed and cancellations will always make their way through the network. The order book that each validator stores is eventually consistent with one another. On a real time basis, orders will be matched together by the network. The resulting trades are then committed on-chain each block.

This allows dYdX V4 to have extremely high throughput for the orderbook (which requires 100x the throughput of trades) while remaining decentralized.

A final note to consider is supported wallets and their UX, if we see new solutions for better user security, we could see the adoption of derivative/perp DEX’s as users won’t be as intimidated to losing their funds.

Which one am I betting on?

It's the big question everyone wants to know, and personally, I'm having a hard time deciding. At the time of writing this article, I don’t have detailed information on Infinex's tech stack unless Sir Kain wants to drop me some alpha and sign a NDA. However, I'm closely connected with the Infinex team and communicate with them daily to stay updated on their developments and research, as it's an area of great interest to me.

Kain and Infinex understand that they're late to the party. If they took the same route as dYdX, they'd lag 12-24 months behind, and in the fast-paced world of crypto, that’s practically a decade. They're tactically leveraging ecosystem adoption and branding. These blockchains hold significant influence, and what’s even more valuable is their user base. While Infinex may not compete with dYdX on spreads and execution, they have a good shot at attracting the "degens", akin to GMX.

From a purely technical standpoint, it's tough to bet against dYdX, especially given their two-year dedication to building a customized infrastructure solely for their trading engine. With their current user base, volume, runway, market makers, tokenomics, team token locks, etc., they appear to be almost untouchable. However, by anchoring themselves to a "ghost" chain, they face a dilemma. Can they win over retail users even if they successfully convert institutional traders? In my opinion, the allure of high-frequency and institutional traders, as I discussed earlier, might overshadow this concern.

With a $20 million incentive program accompanying the release of V4, dYdX is positioned to draw significant volume and revenue. Compared to protocols like GMX, dYdX supports a more expansive token availability with a low float high FDV market cap of $2 billion. By deploying $20 million in incentives, they're only utilizing 1%, potentially boosting new application usage significantly. Meanwhile, GMX is currently seeking 14 million in $ARB incentives, suggesting their user rewards might be depleting.

I'd strongly recommend observing this narrative, especially with so much smart money focused on dYdX over the next six months. This platform is shaping up as one of the industry's major players, and its success could validate Cosmos's potential for launching scalable products that can stand toe-to-toe with centralized entities. I’m holding a bag for the reasons outlined above.

While dYdX and Infinex might be playing the same sport, they're playing by different rules. Both have ample room to grow and capture more of the market share, especially in a bull market dominated by perpetuals. Looking long-term, if dYdX can streamline the user experience and eliminate typical crypto barriers, why would anyone opt for a CEX when they can access a fully on-chain system with comparable trade executions and user experience?

I genuinely respect the direction Infinex is taking. Even if their venture doesn't pan out, the technical breakthroughs and insights they provide will substantially advance our industry, reminiscent of the 1969 moon landing. For platforms like Entangle, which I'm personally invested in, I'm watching Infinex's progress keenly. Their cross-chain messaging aspirations for perpetual platforms align with our objectives, but their approach seems even more ambitious especially with the mountain of security risks that come with it.

May the best perps win.