FactorDAO - Deep Dive

We've seen the rise of token baskets and yield protocols, but have we seen one with this special twist?

Note: Alpha and narratives are located in the bottom half of this deep dive

Overview:

Normally I’m not a fan of projects being DAO’s due to their slow governance, but this team has put together some very interesting infrastructure. With their public sale finishing in a little over two days, lets take a deeper look into FactorDAO…

Factor revolutionizes on-chain asset management by providing the infrastructure to aggregate core DeFi products and liquidity. Their goal is to build a platform, giving protocols, treasuries and individuals the tools to create and manage powerful financial instruments.

Their no code platform is focused on creating a better user experience for asset managers where they can create innovative products, strategies and vaults, acquire TVL, and earn fees. It enables investors to deposit and receive yield with a single click. The idea is to create institutional grade, scalable asset management on Arbitrum.

Liquidity fragmentation is still a huge issue in DeFi which they are looking to solve. Isolated projects don’t have access to new liquidity due to not having the tooling that allows them to interact with new chains or pools. With Factors modified ERC-4626 token standard, liquidity fragmentation is now resolved as asset holders or treasuries now have the option to capitalize on yields from depositing tokens into baskets for unique strategies.

How it works

Factor’s infrastructure for tokenized vaults is based on the ERC-4626 token standard. This standard was officially recognized by Ethereum in Q4 2021 and provides a flexible framework for vault creation. However, the default state of the ERC-4626 contract does not support multiple underlying assets.

This is why they’ve made minor but impactful modifications that expand upon the smart contract's functionality and flexibility. This will allow creators to add multiple supported tokens into the vault, which opens up a vast number of possibilities.

ERC-4626 is a standard to optimize and unify the technical parameters of yield-bearing vaults. It provides a standard API for tokenized yield-bearing vaults that represent shares of a single underlying ERC-20 token. ERC-4626 also outlines an optional extension for tokenized vaults utilizing ERC-20, offering basic functionality for depositing, withdrawing tokens, and reading balances.

What is a Vault and Yield-Bearing Asset?

A vault is a multi-sig solution or smart contract that can store and manage assets such as crypto. Each vault always has the tokens it generates as a form of return. These generated tokens can later be exchanged for tokens that were originally locked in vaults.

Yield-bearing assets are DeFi assets that provide some form of added gain on top of ordinary asset-holding. By owning certain yield-bearing assets, it is possible to earn extra, compounding returns on some DeFi protocols. The value of yield-bearing tokens will always increase so far as the locked tokens in the vault or pool increase.

Why Tokenizing Vault is a Problem?

In a situation where the developers want to build a DeFi app where they’ll need to integrate the tokens of each protocol, they have to research each one, know their model of accruing yields, and adjust it into their code base.

If developers want to integrate vDAI of Maker DAO; stETH on Curve; and so on, developers will need to understand the peculiarities of the smart contracts and build custom solutions to successfully integrate each of them into the DeFi app. Apart from how stressful and time-consuming this process of integrating different yield-bearing tokens can be, it also increases smart contract risk because of potential errors.

What Are The Benefits of ERC-4626?

Since there is a common standard that can be integrated, there is no actual need to build separate adapters any longer. In a nutshell, it quickens development; with composability at its peak.

Similarly, it reduces cost because builders no longer need to get auditors to help with their adapters and interfaces. Most importantly, ERC-4626 enhances security among dApps and yield aggregators that are dealing with yield-bearing tokens.

In a nutshell, the ERC-4626 standard implements the following features:

An optimized vault interface for developers who want to integrate it.

Gives shares as an exchange for a deposit where shares serve to represent fractional ownership of the vault's underlying token

A consistent standard for developers to work with in developing yield-bearing contracts

Battle-tested security for vault tokens

What Makes Factor ERC-4626 different?

Factor’s infrastructure for tokenized vaults is based on the ERC-4626 token standard. This standard was officially recognized by Ethereum in Q4 2021 and provides a flexible framework for vault creation.

However, the default state of the ERC-4626 contract does not support multiple underlying assets. The Factor version of ERC-4626 will allow creators to add multiple supported tokens into the vault, which opens up a vast number of possibilities.

Smooth brain TL:DR

Let's say you have multiple chocolates, all in different shapes and sizes, you want to keep these chocolates for later and stop it from melting, getting moisture/residue inside it or being eaten by a nasty intruder. Factors modified ERC-4626 becomes an adjustable one size fits all wrapper for your chocolates to stop any risk of it melting, getting residue or being eaten by someone else. Now you can keep your chocolate for as long as you want without the fear of losing its value. You could even trade these for chocolates from different chefs and stores now that they’re protected.

Tokenomics:

Factor is focused on rewarding early community members and protocol contributors as they believe this is the most effective way to foster adoption and decentralization. We’ve seen projects like Aptos come under the heat for launching at large valuations which private rounds are exclusively only enabled for the elite. Here’s how Factor is creating long term incentives:

The max supply of FCTR will be capped at 100M. There will be zero emissions beyond this number. No runoff inflationary mechanisms, no ponzi-like tokenomics.

Community above all

Factor will have real community governance, voices won’t merely act as signals to the team

Their tokenomics model aims to reflect this. Over 80% of $FCTR’s supply will be distributed directly to the community.

They believe the collective brainpower of an engaged community can bring DeFi to the next level

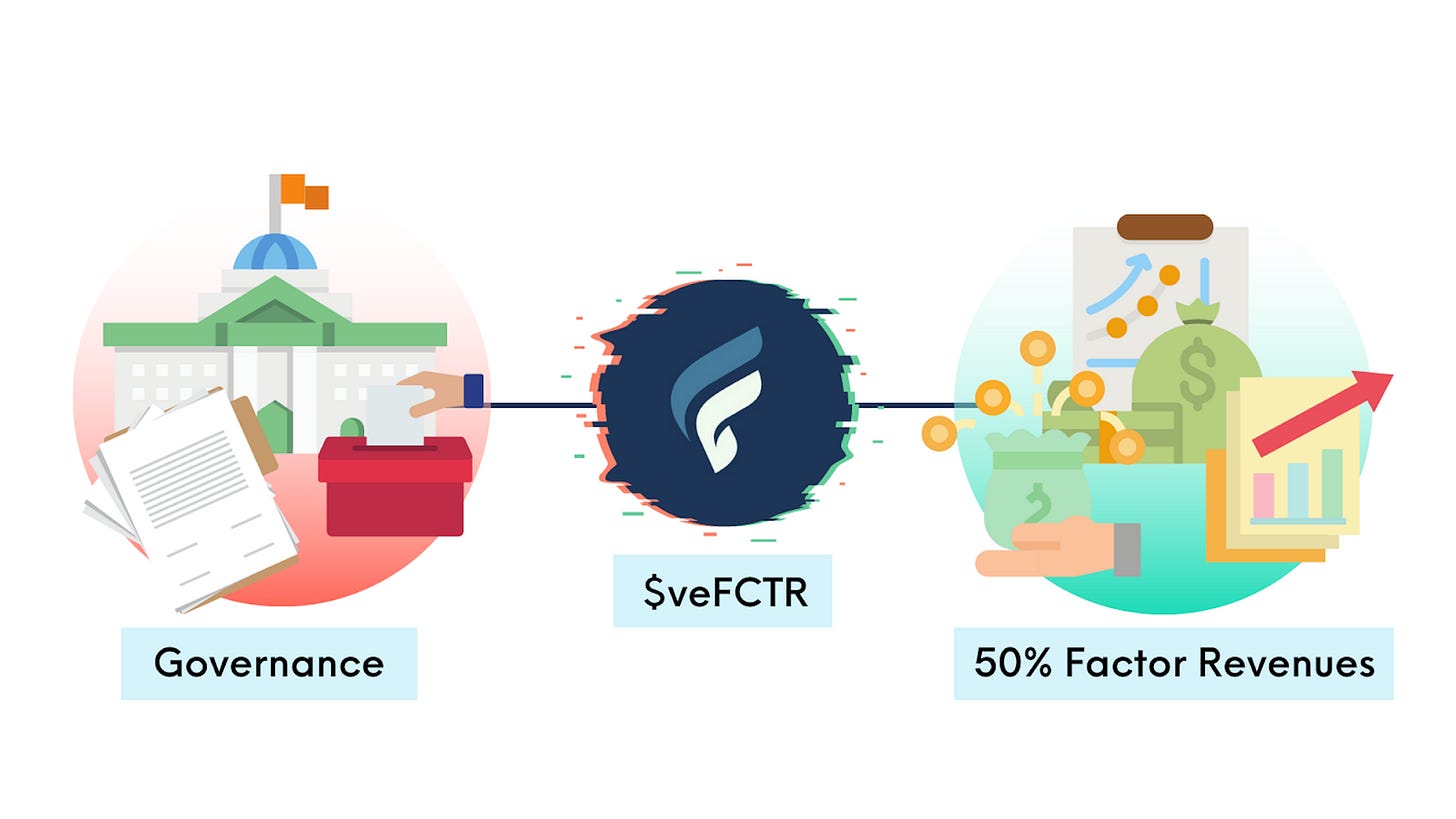

veFCTR

Prevents yield mercenaries

Anti-whale mechanism

Provides long-term incentives

Receives protocol fees and governance rights

Factor offers token holders the option to lock their FCTR tokens in exchange for veFCTR tokens, with longer locking periods yielding more veFCTR. The veFCTR tokens received for locking FCTR are non-transferable, and their amount gradually decays until the locking period expires and the user can reclaim their original FCTR. veFCTR comes with a range of benefits, including the ability to create and vote on DAO proposals. The veFCTR token also receives 50% of all platform fees. The idea is to provide long-term incentives to stakeholders. Additionally, it protects the project from yield mercenaries and serves as an anti-whale mechanism.

An early bootstrapping allocation of 4.2% was distributed at a price of 0.05 (an FDV of $5,000,000, vested linearly over 12 months). This was in order to facilitate the smart contracts audits, development, legal, and marketing required for launch.

The team tokens are vested linearly over 24 months. Unlike for public sale participants, the bootstrapping supporters and team tokens do not accumulate $veFCTR while vested and are required to be unlocked and staked in order to do so. This is to ensure decentralization and fair distribution and rewards for all participants.

Following the public sale, at launch, 32.51% of the supply will be in circulation with slow and steady emissions over 3.5 years. No VCs and no sudden unlocks.

This creates a good opportunity for real yield as those with a long term mindset are going to be benefiting the most from Factors revenue. Something that I really enjoy seeing is an eject button for stakers. If stakers want to unlock their position before the agreed-upon time, they can do so by paying a fee based on the remaining time left in the lock up period (Rage-quit). Some might say this is a negative due to holders being able to unstake and sell onto the market, but to me this gives holders more confidence as they can go in and out as they please.

Revenue Model:

All platform revenue is returned to the ecosystem in a decentralized manner. 50% of platform fees go to $veFCTR stakers, and 50% goes to the DAO to facilitate the operations and growth of the DAO and the subDAO structure as detailed in the Governance section of their documentation.

Stakers can lock their $FCTR for $veFCTR for longer periods of time (from 1 to 4 years) to accrue more $veFCTR and in turn a higher share of protocol revenue and voting rights. The $veFCTR emissions formula is simple:

1 $FCTR locked for 4 years = 1.00 $veFCTR

1 $FCTR locked for 3 years = 0.75 $veFCTR

1 $FCTR locked for 2 years = 0.50 $veFCTR

1 $FCTR locked for 1 years = 0.25 $veFCTR

Platform Fees:

Factor’s primary revenue driver is transaction-based fees. The platform also takes a cut of the creator fees (management fees, performance fees). This cut is currently set to 10%. However, this fee is waived for all creators with more than 10,000 $FCTR staked. A basic outline of the fees is below:

My guess is as time goes on, platform fees will be reduced as they would be a little disincentivizing for some whales who are extremely yield focused. Due to being an innovator and start up, I don’t see many having issues as for now, but as FactorDAO matures, I think it would be appropriate to bring them down. But also something to consider is stakers who are receiving a large portion of this revenue also have governance voting rights.

Acquiring and locking $FCTR for more $veFCTR not only increases revenue share, but also voting rights. Voting can be used to direct treasury emissions and possibly adjust fee structures.

Acquiring significant voting power may allow participants to direct voting and emissions in ways that benefit their goals. Other parties may provide incentives to vote in a specific direction.

This should create a competitive environment to the benefit of the Factor ecosystem. But the team should have a gameplan in place if governance tries to create poor revenue modeling which can affect the health and longevity of FactorDAO.

Valuation metrics

Whilst projecting valuations based on other protocols/ecosystems isn’t the most efficient strategy, it’s how most investors are judging valuations since revenue models are still fairly new and haven’t been battle tested.

Luckily, I have the luxury of an analysis containing other leading lending & yield protocols with the ERC-4626 standard. We’ll explore the ERC-4626 universe and compare several other protocols to get an idea on potential valuations for FactorDAO.

#1: Yearn Finance

Yearn V3 uses ERC-4626 for their vaults, which means these deposits can be funneled to other ERC-4626 vaults easily.

Market cap: $273M

FDV: $306M

TVL: $448M

#2: Frax Finance

sfrxETH is an ERC-4626 compliant vault. sfrxETH is obtained by first approving the sfrxETH contract as a frxETH spender, and then calling mint() (mints a specific number of sfrxETH) or deposit() (deposits a specific amount of frxETH).

Market cap: $1.03B

FDV: $1.03B

TVL: $1.49B

#3: Maple Finance

Maple uses ERC-4626 for their xMPL contract and their RevenueDistributionToken to distribute protocol revenue to staked users with vesting. They are also working on ERC-4626 for Maple V2 LP tokens.

Market cap: $39M

FDV: $53M

TVL: $44M

#4: Balancer

Balancer uses ERC-4626 on their Linear pools, the base component of Boosted Pools to facilitate trades between two tokens at a known exchange rate with linear math. With ERC-4626, you can create a linear pool from any ERC-4626-compatible wrapped token, which then can be subsequently used to create a Phantom Stable pool and Boosted Pool in combination with any lending platform like Aave.

Market cap: $285M

FDV: $700M

TVL: $1.13B

#5: Aura Finance

Aura pools support ERC-4626 for maximum composability. All gauge deposit pools are ERC-4626 vaults with the deposit asset being BPT.

Market cap: $68M

FDV: $310M

TVL: $640M

#6: Sommelier

The team built a dynamic ERC-4626 vault that adapts lending strategies to always get the best yield for stablecoins on Aave.

Market cap: $50M

FDV: $172M

TVL: $14.7M

#7: Alchemix

Alchemix is working on an ERC-4626 adapter for their contract so that they can use ERC-4626 vaults as new yield sources.

Market cap: $37M

FDV: $52M

TVL: $51M

You can see the potential here for creating an innovative asset management protocol leveraging a modified ERC-4626 token. With heavy hitters like Yearn, Frax and Balancer, there is plenty of potential for a new protocol to position itself to capture market share from giants and attractive unaware investors since they now have more options for token baskets.

Being positioned on Arbitrum with the upcoming EIP-4844 upgrade, it seems apparent that we’re going to get a second Arbitrum season, which degens will be on the hunt for new mechanisms to capitalize on. IMO Factor has the team, influence and infrastructure to capture this.

Narrative

How this fits into the bigger picture

Token Baskets

Have you ever been trying to decide on which altcoin to ape into but there’s three different protocols that all look equally appealing and you can’t decide which one to invest in?

Let’s take the recent decentralized derivatives/perps catalyst. Investors are looking for protocols that provide real yield after witnessing the demise of FTX and now want to trade permissionless on-chain derivatives and perpetuals. There are some clear leaders, including GMX, dYdX, Gains Network, and Level Finance. Choosing which token to invest in can be difficult and confusing if you're like most people.

Factor enables you to create token baskets of multiple assets, which could include all of the previously mentioned assets, and then allocate the four tokens under a single token. Just because we want to invest in four tokens doesn't mean we have to distribute them equally. If those tokens have available liquidity, you could divide the strategy however you want, based on your risk tolerance and preferences.

Copy your favorite venture capital: A unique strategy most might not have thought of is the ability to copy leading VC firms. We’ve all seen the gigabrain analyst outperform us most cycles but it can be a pain to constantly monitor and follow their rotations. By creating flexible baskets, users could now have the option to mimic VC investments and not stress on the execution side.

Yield Pools

With the recent liquid staking derivative surge, most ETH holders are looking for the best way to capitalize on yields. Due to the massive amounts of liquidity LSD’s demand, they make a perfect yield option as volatility is fairly consistent.

With the innovation of Factor’s ERC-4626 modification, yield farmers now have the option to create a multi basket approach to their LSD strategy. If you don’t like the market dominance of Lido and the decentralization threat it poses, you now have the option of adding other LSD protocols into the mix such as Rocket Pool or Frax. These can also offer better yields with the addition of risk diversification, sounds like a win-win to me.

The potential to customize risk management and vault composites also opens up an almost unlimited set of possibilities for customizing and combining optimal yield generation strategies unavailable on any other platform. Customization is going to be extremely important moving forward as a plethora of strategies will become available for larger players.

Derivative Origination

We all love to speculate on when the $400T in notional derivatives is going to come on chain.

With Factor, real world assets become available, and not only in their vanilla form. Because of the infrastructure built with ERC-4626, these real world assets can be turned into tokenized baskets or yield pools.

One of the leading factors for decentralized derivative platforms was the addition of real world assets. Users enjoy the fact that they no longer have to leave the web 3 ecosystem and can interact with these assets with no legislation crack downs, the way it should be.

It’s not talked about too often but market neutral strategies will become more apparent as crypto matures and overall liquidity grows. While more common in tradfi, market neutral strategies can allow for a diversification in asset classes which can buffer the volatility normally experienced.

An example of this could be longing lower cap altcoins while being short ETH or BTC. This covers yourself on both sides while also having a higher beta if the market pumps overall as lower cap altcoins are typically higher beta.

Something interesting to consider would be the treasury management of DAO’s/protocols. Often it’s difficult to remove large amounts of capital from crypto without scrutiny from communities. What if you have $100 million under management but don’t trust centralized stablecoins with recent regulatory news? You could convert your treasury holdings into real world assets like stocks and bonds to create a low risk profile for your assets, while potentially getting yield as well.

In what conditions does this project excel:

Majority of innovative projects launching on Arbitrum have been poised for success, that’s not to be confused with all will though, eventually the music stops playing. Camelot was a great example of this, it rumored around in alpha discords while at $200 and stayed flat until smart money piled in and did a 15x over three weeks.

The Shanghai unlock and EIP-4844 will bring a wave of new liquidity and technological upgrades to DeFi and Arbitrum. With ETH staking being unlocked, billions of sidelined capital now has the ability to enter new ecosystems. With Arbitrum becoming 20-100x cheaper to use, I’ve got a good feeling where a lot of funds will be flowing.

Gains network was one of the most impressive decentralized derivatives platforms in recent months, this has primarily been due to the trading of real world assets. With Factor's ability to customize RWA’s into tokenized baskets, all under the one token, it makes for a perfect use case in crypto. No more brokerage firms or online management, everything can now be done under the one web 3 roof.

LSD’s are the talk of the town and now you don’t have to pick yield from a specific one, with the ERC-4626 modification, the option to have several underlying assets under one token is possible. If risk management is your style, then the ability to leverage diversification at this level will be very appealing. What’s even better is the rage quit ability to unlock veFCTR by just paying the necessary fee so you have the satisfaction of removing liquidity when needed.

What’s going to change the liquidity game is when more treasuries feel comfortable depositing 8, 9 and 10 figure amounts for yielding purposes. It’s too risky for most protocols to go long assets in crypto due to high volatility. If given the chance to receive single or double digit APY’s on stable assets, it could greatly expand the runaway and stress levels of large teams. If we create a product leader who can comfortably onboard these treasuries, we’ll see their TVL and user activity sky rocket.

In what condition does the project not do well:

Firstly, put yourself in a treasuries shoes who’s currently managing $100M, let’s say your community is asking for a way to diversify to gain yield with low risk assets. You see a potentially new protocol which is offering 7% yield on stables or low volatility RWA. Every year you’re netting $7 million from doing so, but you’re also risking $100M in smart contract vulnerabilities.

For myself, I simply wouldn’t be taking the risk until extremely proven and battle tested, even then, I most likely wouldn’t commit to that sort of risk. While we’d all like that type of passive yield, in crypto’s current form, the risk far outweighs the reward. This doesn't mean it won’t change in the future, but we have to be realistic with short to medium term expectations.

But this large risk can also be a positive for smaller projects, as it allows them to take higher risk with ecosystem development by providing liquidity to other protocols. This is how I imagine the Factor team will need to move forward, as big players will need more time for convincing before they come onboard. Ecosystem is everything for asset management, it’ll be important to pay close attention to how effective the BD team is able to move and build relationships.

Creating tokenized baskets means creating liquidity, if the team is unable to bootstrap sufficient liquidity for at least several assets then we’ll see no real adoption. Considering there’s no VCs, it might be hard to find strong connections to potential market makers/large liquidity providers. Whilst there’s a negative stigma around VC’s, it can be very useful to have the liquidity bootstrapping they provide with their assets. But on a positive note, the protocol is fully under the control of the community.

A final thing I ask myself is why would I use this product when others such as Frax or Balancer exist? How is the Factor team innovating in a way which will draw eyes away from big players. Obviously this article highlights that but if you’re looking long term, will the team be fast enough to innovate on new strategies moving forward and have the capabilities of stimulating new liquidity for them. DeFi is very cut throat atm considering it’s been in a prolonged bear. Only those who are quick enough to move will survive this winter.

Opinion Zone

Where I think this project can go fundamental/price wise:

I wouldn’t have made this extensive deep dive if I didn’t think this project has potential for some serious upside. What caught my attention was the team behind this, most are DeFi gurus and have strong content platforms on twitter which allows them a lot of leverage. I’m consistently in alpha discords/telegrams and over the last couple weeks I've been constantly seeing Factors name pop up by reputable players.

If the team has the BD skills to onboard small-medium ecosystems to provide liquidity and incentives for yield and token pools, I believe we’ll see price closely correlate with a rapidly expanding TVL.

My biggest concern would be with the size of the team as there’s only currently 10 listed full time members, with only half being dedicated to operations, marketing and BD. It takes a lot of man power to launch a project like this, creating partnerships, content and documentation is no easy feat. Hopefully we see them expand with the new funding from the public sale.

Arbitrum is about to take off with the new EIP-4844 upgrade, along with new liquid from the ETH staking unlock. LSD’s will most likely pick up a bit of steam again, causing most to look for complex yield strategies to capitalize on the most profit possible. User activity and TVL on Arbitrum protocols like Factor will be the talk of the town as they are positioned best.

The two things I’m going to be paying the most attention to are new partners who are benefitting the ecosystem and TVL. If those are growing in a consistent way then I feel there’s little reason for this project not to succeed.

The public sale has already raised over $5.3M with over two days still to go at time of writing. As the sale comes closer to an end, investors typically are poor due to fomo so my guess is it will finish somewhere in the $7-10M raised. This would put the circulating market cap around $22.4-$32M.

With a circulating market cap of that with zero product launch as of yet, I feel it’ll probably have a sell off within the first week as investors double guess themselves which is where I’ll be buying, hopefully 🙂

Price will come down to ecosystem development IMO, if there’s strong partnerships and TVL early on, I can see this growing to $100-200M circulating market cap. Anything more would be quite a steep push considering only just launching, but long term if the team delivers there’s no reason why it can’t compete with blue chip yield and basket protocols.

Liquidity:

Liquidity will initially be 40% of the raised funds from the public round, but it will be continuously added, through LP fees and some of revenue fees (subject to DAO).